In all of the years that I’ve been writing content for this blog, I don’t think I’ve ever detailed – let alone briefly covered – identifying or avoiding project scams that small business owners and freelancers can deal with when it comes to the emails we get.

This isn’t to say larger businesses don’t – because they do – but they also tend to have greater resources to fight that kind of stuff when it happens. Plus, smaller businesses are likely more of the target of petty crimes.

Even still.

Over the last few days, I’ve been corresponding with someone who had looked to hire Pressware for some work. It seemed like a scam from the beginning, but I opted to take the bait and to see how far it would go.

Ultimately, the point was to help others in our business with identifying and avoiding project scams (not to waste time).

I have small scale business which i want to turn into large scale business now

Usually, these things will converge to a point where they need some type of help with money, credit card charges, or the infamous use of Western Union (which I’ll cover later).

So for the sake of having this documented for others, I’m sharing all of this – and similar posts I found around the same type of scam – in this post.

Identifying and Avoiding Project Scams

I want to make sure I hit the highlights for anyone who may experience this particular scam or who may find this in a search engine, via Twitter, or what else. It’s replete with screenshots, quotes, and all of the tips I could think to include to ultimately help you get better at avoiding project scams (because I think it’s a learned skill).

This is what sets it all in motion.

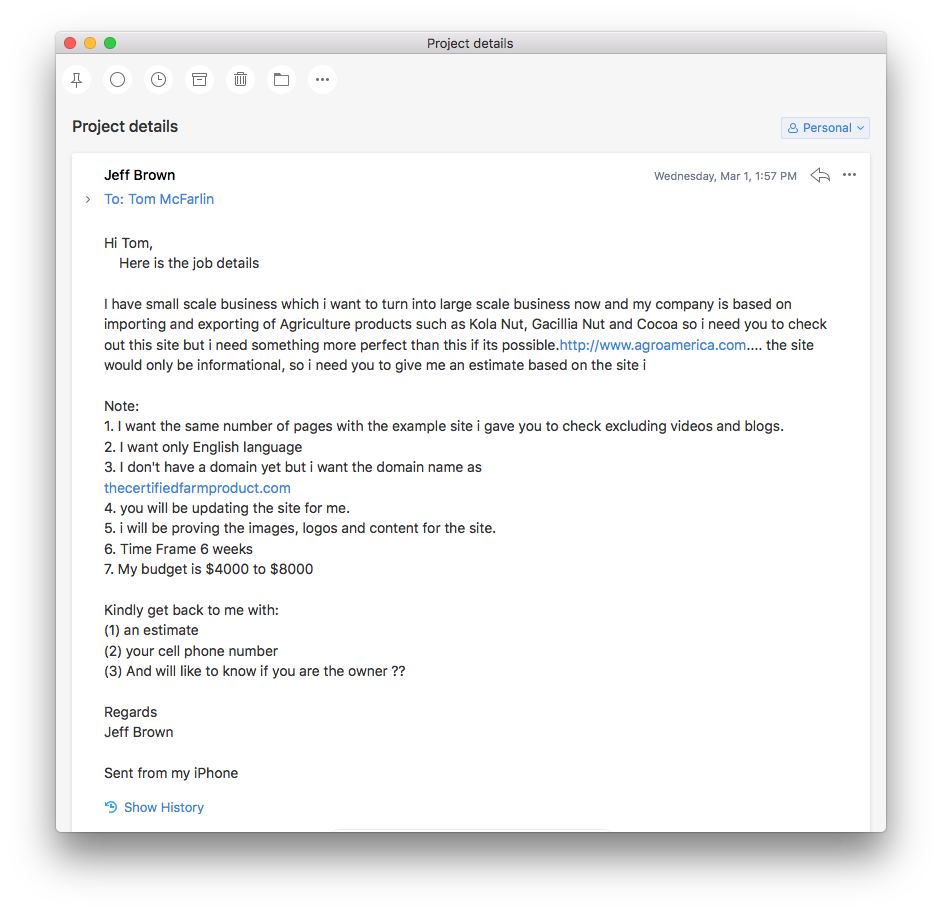

Anyway, the scam starts off simple enough with the person looking to hire someone for work:

i would love to know if you can handle website design for a new company and also if you do you accept credit cards or eCheck ?? kindly get back to me ASAP so i can send you the job details.

But one indication that something might be off is that the grammar and punctuation is bogus and they want to move fast. (After all, who wouldn’t want simple work and money quickly? It’s a dream job, right? 🙄)

Sure, I’ll bite if for no other reason to see where this goes.

So I move forward, link them to Pressware’s site for more information, and I get another email that is not a reply to the thread that was initially started. I don’t expect everyone to always stick in a single thread, but they shouldn’t necessarily be starting a new thread every single time they contact you.

This is where the scam starts to feel exactly like every other scam and where your “I need to remember all the info about avoiding project scams” comes into play.

“I have a small scale business…”

First, it opens with the following phrase:

I have small scale business which i want to turn into large scale business now and my company is based on importing and exporting of Agriculture products such as Kola Nut, Gacillia Nut and Cocoa so i need you to check out this site but i need something more perfect than this if its possible.

The second part of the email contains the details of what they want.

At this point, it’s clear this is a scam because of the opening line, the punctuation, the desire for a an estimate when they are providing a budget, a time frame, and using odd phrases like “I want the same number of pages with the example site i gave you to check excluding videos and blogs.”

Again, you want to pay how much for how little of work? And very few clients use “X number of pages” in their explanation unless they are looking for brochure sites.

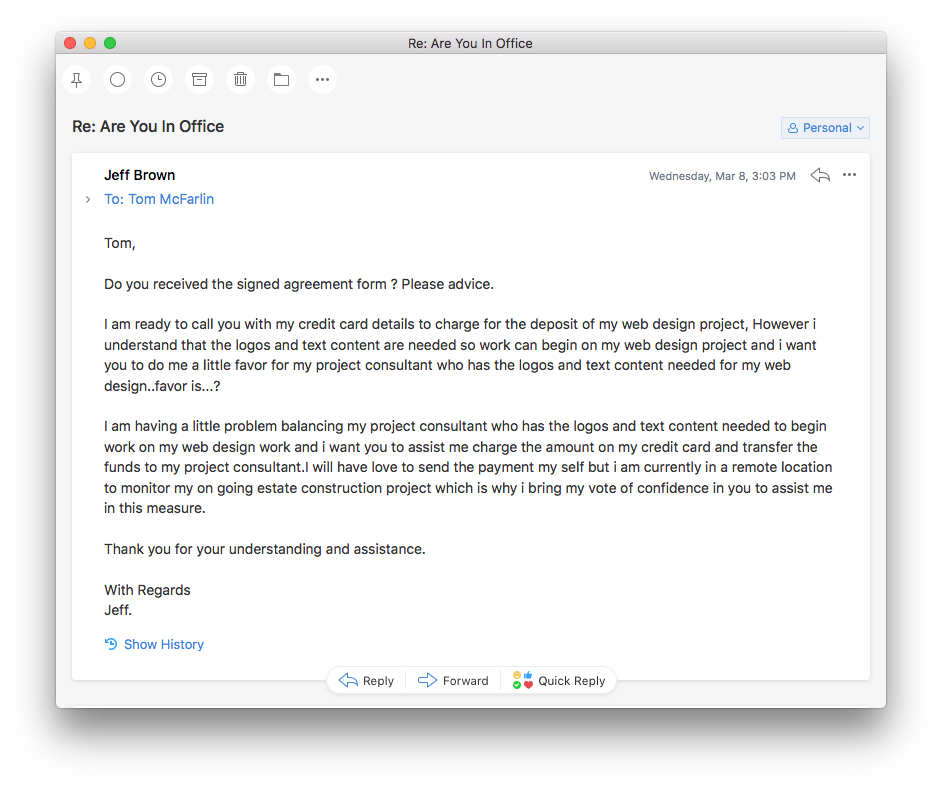

“I am having a little problem…”

So I go even further sending a basic statement of work and the terms and conditions (no, not much time was spent putting the statement of work together since “Jeff Brown” basically provided everything I need. 😂).

And then they start asking for additional work.

And then they start asking for additional work.

Now it just gets weird:

I am having a little problem balancing my project consultant who has the logos and text content needed to begin work on my web design work and i want you to assist me charge the amount on my credit card and transfer the funds to my project consultant.

And then:

I will have love to send the payment my self but i am currently in a remote location to monitor my on going estate construction project which is why i bring my vote of confidence in you to assist me in this measure.

Then the nail in the coffin identifying this as a scam:

He told me that he his in the middle of transferring his business and that at this point in time he only accept payment via money gram or western union

As with most scams, this converges to MoneyGram and Western Union. You’d think after all of this work, it’d be at least a little more creative. But no. Aiming for 20 pages in an English-only site with no videos or “blogs.”

“He only accept payment … western union…”

By now, it’s time to bow out for reasons that are obvious (you want a developer to help you work with your project consultant, transfer funds, deal with credit cards, and you want all of this done via wire transfer none of which is covered in a statement of work or terms of conditions which you signed?).

Avoid project scams by avoiding Western Union.

I’m not hired to build a 20 page site for a competitor and run interference with a project consultant.

Jennifer Lawrence knows how to avoid project scams.

Sure, I could’ve dismissed this and just moved forward but it takes how much time to reply to this kind of stuff via email?

And if it helps me write this kind of stuff for those who are new to the this kind of stuff and can save them from people like this, then I’m more than happy to document the process.

Red Flags For Scams

I hate to use a cliché, but if you get a job when something sounds too good to be true, it likely is. Case in point: $8,000 for a 20 page site in which all assets are provided and you don’t have to incorporate any other media? 😏

Here’s a short list of things to look for whenever you’re receiving emails that are likely going to be scams:

- Did the email come from this blog’s contact page or my business’ site?

- Does the email address look like a throwaway or something legit?

- How fast are they looking to move on the work?

- Does the person tend to follow on a single thread of email?

- The person puts pressure on making the payment regardless of when you tell them you can start the project (I told them two months out to test this.)

- If they ask for any type of MoneyGram or Western Union, it’s almost guaranteed to be a scam (I would say it’s guaranteed to be a scam, but I’m sure someone has had a positive experience).

Sure, there are more and I’ll leave comments open for those of you who have experiences with things like this so you can share your own tips for those who stumble across this post.

What’s With Western Union?

Ultimately, this can play out in a number of different ways but the short of it is that the money will be deposited into your account and they’ll often send more “by accident” than what was quoted.

Then when they dispute the charge, you’re left with having to pay them back plus the additional funds. You’re out more than you planned, they’ve made a profit, and you’re left with nothing more than fewer funds than when you started (with a bit of frustration to boot).

In fact, Western Union themselves provides a laundry list of ways that scams can work using their business model.

A Word About Credit Cards

A friend of mine recently asked me if I accept credit card payment for projects. It’s a good question because with the ability to claim fradulent charges and whatnot, it’s not always a great way to accept payment.

The short answer for this is “yes” but the longer answer is “it depends.”

Simply put, it depends on the relationship that I have with a customer. If I know them in the sense that I’ve met them via phone calls, multiple meets, or even had dinner with them, and I’ve vetted them, then I’m okay doing a partial payment.

I also think it’s wise to accept a downpayment before beginning any work to ensure they are bought into the project. If they won’t provide a downpayment, then I usually won’t begin any work. And this is something that I think most people who are running a small business, especially online, should adopt.

There are exceptions for some clients but these are people and organizations with whom I know and trust. It’s not my general rule for beginning work.

A Final Word on Running Your Business

I’m not here to tell you how to run your business. Whatever plan, mission, vision, and way you go about structuring your business is, ahem, your business.

But there are things that are common in this industry and if any of the experiences that I – or others – have to share can help you shortcut mistakes that you could possibly make, then at least consider (if you’re not going to follow) the advice.

The point is to provide a way to help you help yourselves when running your business. Far too many people fall victim to this sort of things especially when starting out and end up feeling discouraged, foolish, and if they shouldn’t even be in business for themselves.

And though I’m not trying to invalidate anyone’s feelings, this is something that people do experience more frequently than not (as sad as that is). When you learn from the mistakes of others and avoid the same problems, then you’ve just gotten a bit of wisdom.

This wisdom is something you can take with you back to work and focus on clients and projects who are the real deal. Not some pathetic person working harder to scam people out of their honest money through dishonest means than actually putting forward work that would actually contribute to the economy than cause it to faulter a bit.

Help Get the Word Out

Finally, if this is helpful or you think it’s helpful for others, please retwet this post. I never ask for readers to do this.

But if it’s something that will help others in our industry and in our position, then I’d love to help as many people as possible. And that’s what the entire post is about, anyway.

Variations of This Scam

Finally, and as promised, here are some other links to resources for those who have experienced the same variations of this scam.

- Web Designers Beware

- Web Design Scam! Heads up!

- Email Scams Target Web Designers

- “I have a small scale business which I want to turn into a large scale business.”

- Designers/Developers: Don’t fall for this scam

Even if you don’t see exactly what I’ve posted above, then peruse the posts above to see variations on the scam in the links above.

Leave a Reply

You must be logged in to post a comment.